How to Analyze a Company's Balance Sheet for Stock Investments?

Author: sana

Do you trade in the company but need more time to read the balance sheet? That's like purchasing a car without ever bothering to look at that.

Many investors make this common mistake; they focus on spectacular figures rather than the foundation of a company's financial structure.

Think about it. What are the companies you have encountered instances where a stock has crashed because of what investors called "emergencies"?

Debt piling up? Cash reserves dwindling? Lack of 'sexiness' in the assets? These may signal doom to your investment. But here's the catch: they're easy to identify if you know where to look.

This guide will explain how to Analyze a Company's Balance Sheet for Stock Investments. There will be no more guessing, no more shooting in the dark, and no more doing what everyone else is doing.

Ready to level up your investing? Let's examine balance sheets more closely and see what they can tell us.

Importance of Analyzing a Balance Sheet

Have you ever considered how some investors have unnatural feelings about stocks? They are often not clairvoyant—they can only read balance sheets.

A balance sheet is suggested as a health report for the company. It shows whether a business is in good shape to compete or is struggling to survive.

It would help if you were assured of this before you spend your precious money on a particular football team.

A balance sheet provides essential details about a company's financial structure. It informs you of its number of companies, liabilities, and equity. Simple, right?

How much debt do you have? Stashing money in your pocket? The balance sheet knows all these things.

By solving this code, you are investing and making correct predictions based on facts. In the stock market, that's as close to the superpower as one can get.

Critical Components of a Balance Sheet

We will now explain a balance sheet as though it were a piece of luggage, and the various components were the items in it. What's inside? Three main compartments: This is made up of what's assets, liabilities, and shareholders' equity. All companies have different aspects of shareholders' financial narrative.

1. Assets: The Treasure Chest of Company

Assets are all the things that the company has that are valuable in some manner. There are two types:

Current assets are the whiz kids of balance sheets. These are items that the company can sell or convert into cash within one year. It includes:

● Cash: The money in the bank is minimal; it only holds a little cash or valuables on its premises. Simple.

● Accounts Receivable: A current asset is the amount of money customers have consumed but have not paid for.

● Inventory: Products that are virtually waiting to be sold.

These indicate how a firm can meet its obligations in the short term with relative ease.

Fixed assets are the business' long-term investments. These stick around for more than a year:

● Property: Structures, shelter, offices, plots.

● Equipment: Laptops, machines, cars.

● Long-term Investments: This can include shares and other types of bonds bought to hold them for the long term.

These display a company's muscle and growth potential for the long term.

2. Liabilities: The IOUs

Now, flip the coin. Liabilities are obligations due to others by the business. Again, we've got two types:

Current Liabilities are the "pay now" s of liabilities. These are due within a year:

● Accounts Payable: These are the monies due to suppliers for goods and services the business receives.

● Short-term Debt: Borrowings that are to be repaid shortly.

● Taxes Payable: The share that goes to the taxman.

These show if a company could be in a position to experience a liquidity squeeze soon.

Long-term liabilities are the marathon debts:

● Long-term Loans: Massive credits such as home loans.

● Bond Payable: Amounts which are due to bondholders.

These reveal the company's long-term liabilities.

3. Shareholders' Equity: The company's Owner Slice

This is the balance iShareholders' disposal of the Owner's assets and clearing all liabilities. It includes:

● Common Stock: A portion of the consolidated business belongs to the shareholders.

● Retained Earnings: The funds that were not distributed remained in the company's reservoir.

Similar to one's equity, it indicates the company is owed to the Owner's company.

Crunching the Numbers: Figures of Merit/Key Ratios

Now, let's play financial detective with some key ratios:

1. Culet's Ratio = Current Assets / Current Liabilities

This shows whether the company is in a position to meet its short-term liabilities. Higher is usually preferable, yet if it goes too high, it implies that the company needs to use cash optimally.

2. Debt-to-Equity = Total Liabilities ÷ Shareholders’ Equity

This shows the proportion of debt financing against financing through Owner's equity. Lower generally signifies lower risk, but some owners can be growth-enhancing.

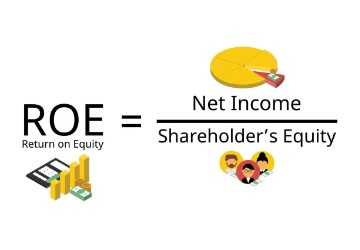

3. Return on Equity (ROE) = Net Income / Shareholders' Equity

This tells you how efficiently the compShareholders'nvestors' capital to make a profit. ROE tends to increase with performance, thus the self-reinforcing nature of higher ROE.

Note that these ratios are not the actual picture but provide some indications of the accurate picture. Employ them as initial entry points to further analyze a company's financial situation.

When you comprehend these companies and ratios, you analyze figures and, instead, the genetic makeup of their financial structure—essentially, trading with A. I. is like having an X-ray vision for stocks.

Employ it, and you will be leagues ahead of all the other stock market investors.

Employ it, and you will be leagues ahead of all the other stock market investors.

Take Charge of Your Investments

Are you ready to elevate your investing game? Now's the perfect time to embrace balance sheets. Just as you now can't buy a car without checking under the hood, you shouldn't stay in stock without examining their financials.

The balance sheet is your key to avoiding financial lemons. Next time you're eyeing a stock, focus on the balance sheet. Assess the you're, evaluate the debts, and calculate what's left for shareholders. It might feel like homework, but what's crucial?

In the stock market, information is power, and it's sheets are your secret weapon. Use them wisely, and your portfolio will thank you.

Frequently Asked Questions

Q: What are the main components of a balance sheet?

Ans: A balance sheet can be considered a picture of a company's financial position at a specific time. It reveals the companies a company controls, its obligations, and the amount that belongs to the shareholders.

Q: Why is the current ratio important?

Ans: The current ratio is a company's financial system health check. It lets you know if a company can meet company obligations. A high RAE means the company is well placed, while a low one could mean it is in big trouble.

Q: What does ROE indicate?

Ans: ROE is considered a report card that indicates how well a company manages its money. It indicates how efficient they are in converting investors' cash to profits.